s corp tax calculator nyc

This could potentially increase the S-corp tax bill significantly and. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted.

Moving To New York City What You Need To Know Moving Com

Fixed Dollar Minimum Tax is.

. For example if you have a. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. However one major difference from c.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Our S Corp Tax Rate guide explains how S corp taxes work and how to determine if an S corp is right for your business. This calculator helps you estimate your potential savings.

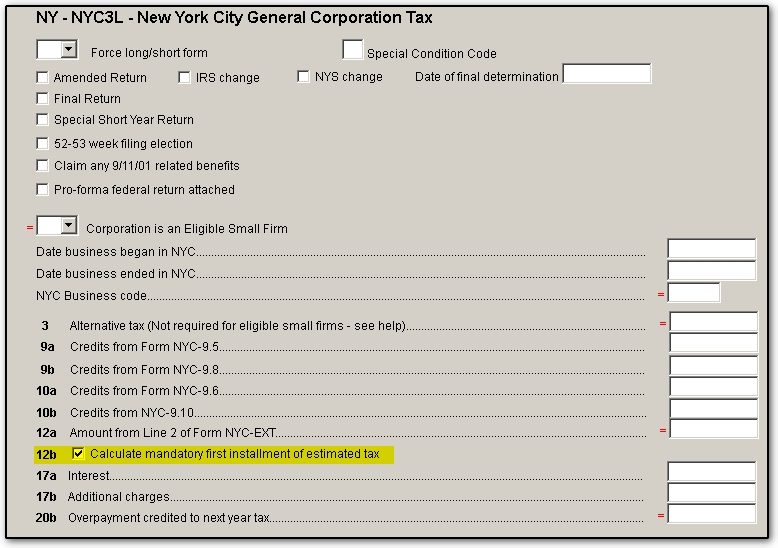

For corporations exceeding the 290000 limit the tax rate is 71 cents. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the. If your company is taxed at a high level try our S Corp tax savings calculator.

Regardless if youre self-employed or an employee you have to pay Social Security and. Pick The Right Entity Type In Minutes. More than 100000 but not over 250000.

New York Estate Tax. New Yorks estate tax is based on a. Join 300000 Companies That Trusted ZenBusiness To Launch Their Business - Start Today.

This is with the exception of a few New York manufactures that have qualified for a flat 65 percent rate regardless. Partnership Sole Proprietorship LLC. C-Corp or LLC making 8832 election.

S corps create tremendous savings because they reduce the biggest expense many llc owners face. However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885. S-Corp or LLC making 2553 election.

Taxes Paid Filed - 100 Guarantee. In order to gain New York tax-exempt status a corporation must qualify as a 501c and obtain a Nonprofit Tax-Exempt ID Number from the IRS. S Corp Tax Savings Discover possible tax savings by comparing S Corp to LLCs in your state.

This guide will quickly teach you the major mechanics of how your taxes and this tax calculator. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. From the authors of Limited Liability Companies for Dummies.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Check each option youd like to calculate for. Not more than 100000.

Taxes Paid Filed - 100 Guarantee. In new york city for example the general corporation tax is imposed on all corporations. If New York City Receipts are.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. How s corporations help save money. More than 250000 but not over 500000.

But as an S corporation you would only owe self-employment tax on the 60000 in. Not more than 100000. New York may also require nonprofits to file.

New York Estate Tax. S corp vs llc tax savings calculator. 100s of Top Rated Local Professionals Waiting to Help You Today.

Photo by Dimitry Anikin. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Does Your Business Need An LLC Or S Corp.

We are not the biggest. Discover Helpful Information And Resources On Taxes From AARP. If youre a solopreneur making at least.

Forming an S-corporation can help save taxes. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

New York State Enacts Tax Increases In Budget Grant Thornton

New York City Taxes A Quick Primer For Businesses

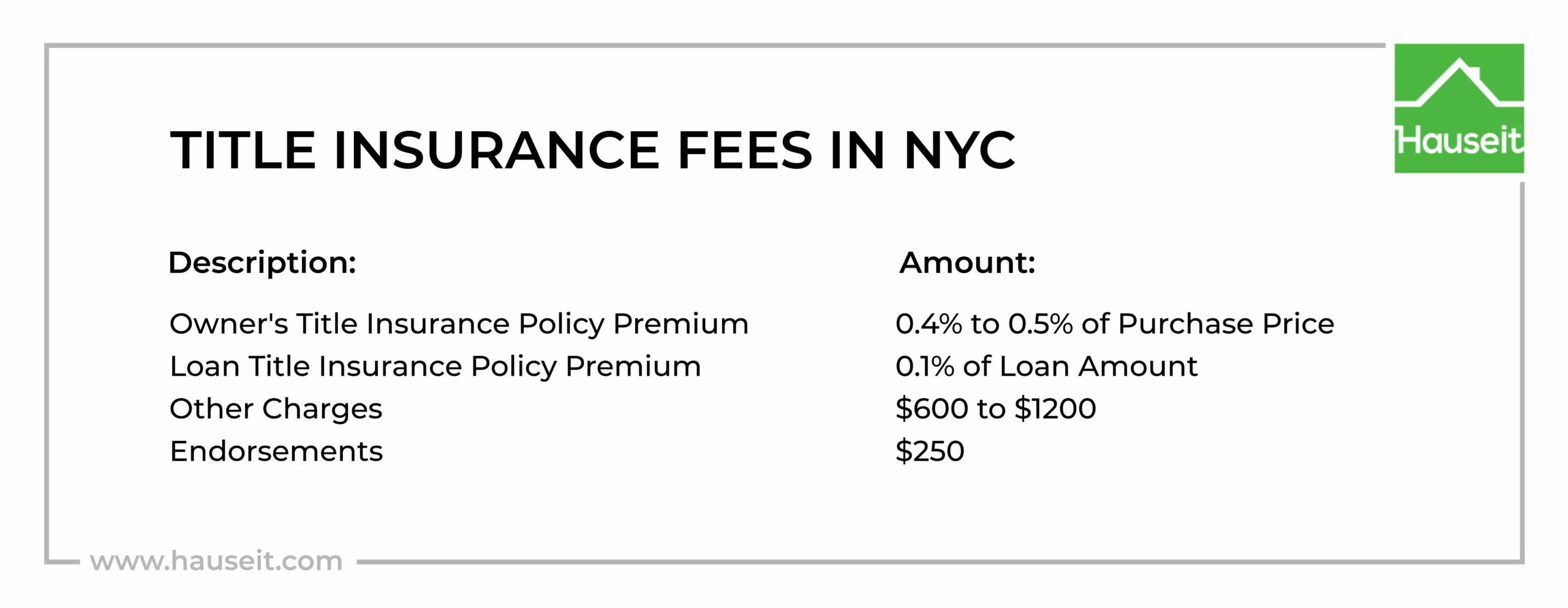

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

New York City S Corp Vs Llc S Corps Aren T Recognized In Nyc R Accounting

Follow Women Corporate Directors Wcd S Womencorpdirs Latest Tweets Twitter

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

Co Op Maintenance Tax Deduction Calculator Interactive Hauseit

Ny State And City Payment Frequently Asked Questions

Little By Little New York City Workers Are Heading Back To The Office Marketwatch

New York City Taxes A Quick Primer For Businesses

/pedestrian-architecture-road-skyline-traffic-street-71505-pxhere.com-ea7fd4d112754938828312ff123c084c.jpg)

Top 10 Most Expensive Cities In The U S

Ny State And City Payment Frequently Asked Questions

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Ny State And City Payment Frequently Asked Questions

The Most And Least Tax Friendly Major Cities In America

/taxes_in_new_york_for_small_businesses_the_basics-5bfc3575c9e77c005145c81b.jpg)

Taxes In New York For Small Business The Basics

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander